The Finance Act for 2025 confirms the abolition of one-off fiscal representation for imports under customs regime 42, a mechanism widely used by non-European companies, including those from the UK. This change will take effect on 31 December 2025, giving affected businesses a few months to prepare.

What does this mean in practice?

The one-off fiscal representation (also known as ‘limited fiscal representation’ or ‘limited tax representation’) regime, set out in Article 289 A III of the French General Tax Code (CGI), is being repealed. Registered customs representatives will no longer be allowed to use their own VAT number to act as a one-off fiscal representative for non-EU companies importing under customs regime 42.

As a result, non-European businesses will now need to:

- Register for VAT in France;

- File their own VAT returns.

The new fiscal agent regime under Article 289 A bis does not cover imports under customs regime 42 00, so it cannot be used as an alternative.

Direct implications for non-European companies

- They must obtain a French VAT number and file their own VAT returns.

- The new fiscal agent regime (Article 289 A bis) does not apply to imports under regime 42.

- UK companies and other non-EU businesses should register for VAT in France before 31 December 2025 to continue importing under Incoterm DDP.

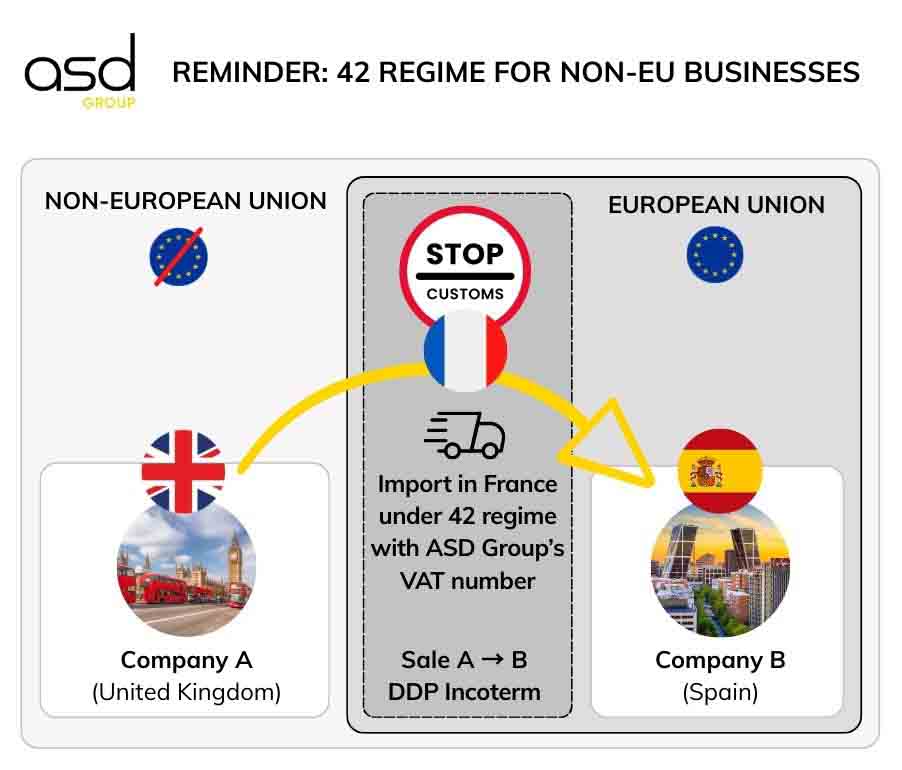

How regime 42 worked with limited fiscal representation

Example: A UK company sells goods to a Spanish client under Incoterm DDP. The goods are cleared through customs in France, with the UK company as the official importer, and then shipped immediately to the Spanish customer.

Conditions for VAT exemption on imports:

- The imported goods must be shipped to another EU Member State (e.g., Spain) under regime 42.

- The official importer in France must be the seller (e.g., the UK company).

- The intra-EU shipment must follow immediately after import (max. 48 hours in practice).

- The importer must provide customs with proof of intra-EU transport.

Role of the one-off fiscal representative

Until 31 December 2025, a UK company could appoint a limited tax representative (e.g., ASD Group) using their own VAT number in the customs declaration. This representative also handled all tax reporting obligations, including:

- VAT

- EU sales lists

- Intrastat

This arrangement allowed non-EU companies to avoid French VAT registration and reduce administrative costs.

Why regime 42 will lose its appeal after 2025

Since 1 January 2022, the self-assessment of import VAT under regime 40 has become widespread. This allows imports into France in a VAT-neutral way, with simultaneous collection and deduction on the French VAT return, making regime 42 less advantageous.

Limitations of regime 42 after the reform

- Non-French companies (particularly UK-based) could previously avoid VAT registration in France.

- From 1 January 2026, VAT registration in France will be mandatory for imports under regime 42.

- Regime 40 already provides a simplified, cash-flow-neutral mechanism, without upfront customs payments.

➡️ Conclusion

Regime 42 will no longer be attractive for non-European businesses. Using regime 40 directly will be simpler and more consistent for imports.

How UK companies can prepare

From 2026, alternatives for regime 42 include:

- Obtain a French VAT number: Mandatory for importing under regime 42.

- Adjust import processes: Review logistics to comply with new requirements, including intra-EU deliveries.

- Train staff: Ensure teams understand new tax and customs rules.

- Consult experts: Tax or customs advisors can help avoid costly mistakes.

- Update accounting systems: Incorporate new VAT obligations for smooth intra-EU transactions.

- Inform clients and partners: Communicate upcoming changes to ensure a smooth transition.

- Assess financial impact: Adapt business strategy to reflect the new regulations.

By implementing these steps, UK companies can smoothly transition and continue importing without disruption.

Anticipate VAT registration with ASD Group

From 1 January 2026, all non-EU businesses must be registered for VAT in France to continue importing.

ASD Group can assist with VAT registration to secure your import-export operations in the EU.